Customer Stories: Payment Platform

Create a secure and easy payment platform for title companies to handle millions of dollars in transactions to prevent fraud in the real estate industry.

The Challenge

Our client aimed to revolutionize the real estate payment processing experience by tackling fraud in wire payment transfers. Being a fintech startup, they knew speed was of the essence in introducing their cutting-edge SaaS white-label ACH application to the market. We helped them get there fast so they could be first to market.

This innovative platform allows mortgage and title companies to seamlessly utilize it under their own brand, effortlessly collecting funds for closing costs and earnest money deposits and sending out disbursements to both clients and vendors.

Secure and Stable Architecture

The backend included several services: Transfer, Security, Authentication, and AWS - SQS & Lambda.

Our Objective

Enable users to securely link their bank accounts and seamlessly transfer funds while updating the database with essential logs, data, and status updates.

Approach

We utilized Plaid for account verification & Dwolla to process ACH transactions, storing important data via GraphQL. Routes for functionality and data retrieval were made accessible via a Node/Express REST API.

Result

Millions of dollars have been securely transferred using these services.

Product Management

We introduced Design Thinking to the client and workshopped ideas to define features and prioritize them into a product roadmap. From there, we documented more detailed user stories and user flows in Confluence before creating tickets in Jira. Next, we ran agile sprints and worked alongside our client to iteratively design, develop and deploy new features every 30-60 days.

To ensure no knowledge loss occurred, we created and maintained a robust knowledge base in Confluence for the client and added common definitions, team roles, background documentation and several requirements, technical and design documents.

We created multiple responsive UI's for various client segments, B2B, B2C, and administrators.

.png)

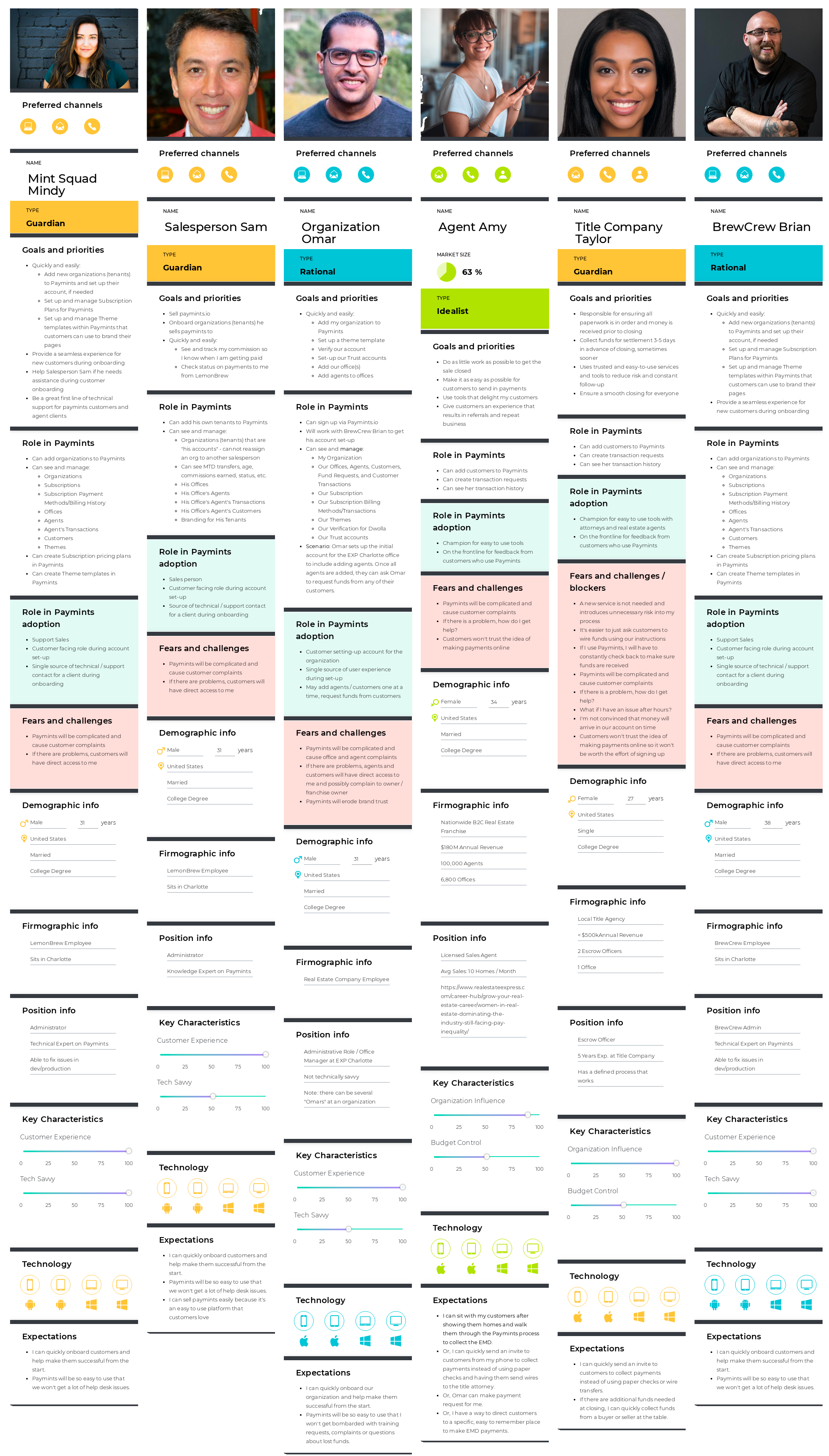

Research

Predictive UX conducted interviews with key stakeholders and actual users to understand who would be using the payment platform. Our research initially resulted in the design of 6 different personas. We later added 2 more personas based on how the app features changed over time.

We used the personas frequently throughout the lifecycle of the project in the following ways:

- Onboarding new team members to help them understand the end users

- Creating user flows that branched to include alternate paths for different persona types with different levels of access, sometimes crossing over to other UI's

- Authoring user stories so that we could keep the perspective clear to designers and developers with regard to who would benefit from the story feature

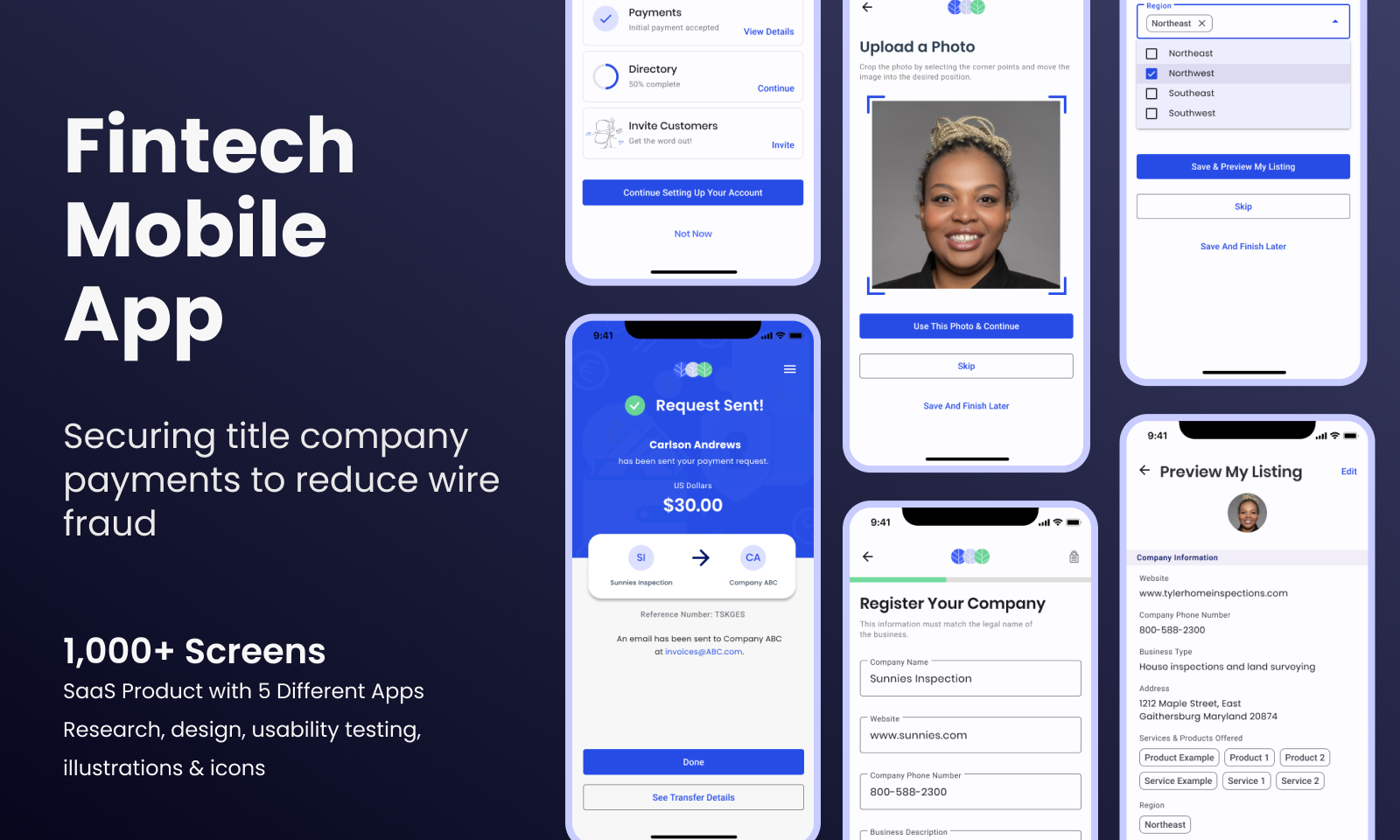

Wireframes and High Fidelity Prototypes

We created over 1,000 wireframes and multiple interactive prototypes of various features and UI's to include:

- Admin UI

- Client UI

- Secondary Approvals

- Routing by Office

- Realtor UI

- Pro UI

- MuniPay

- VendorPay

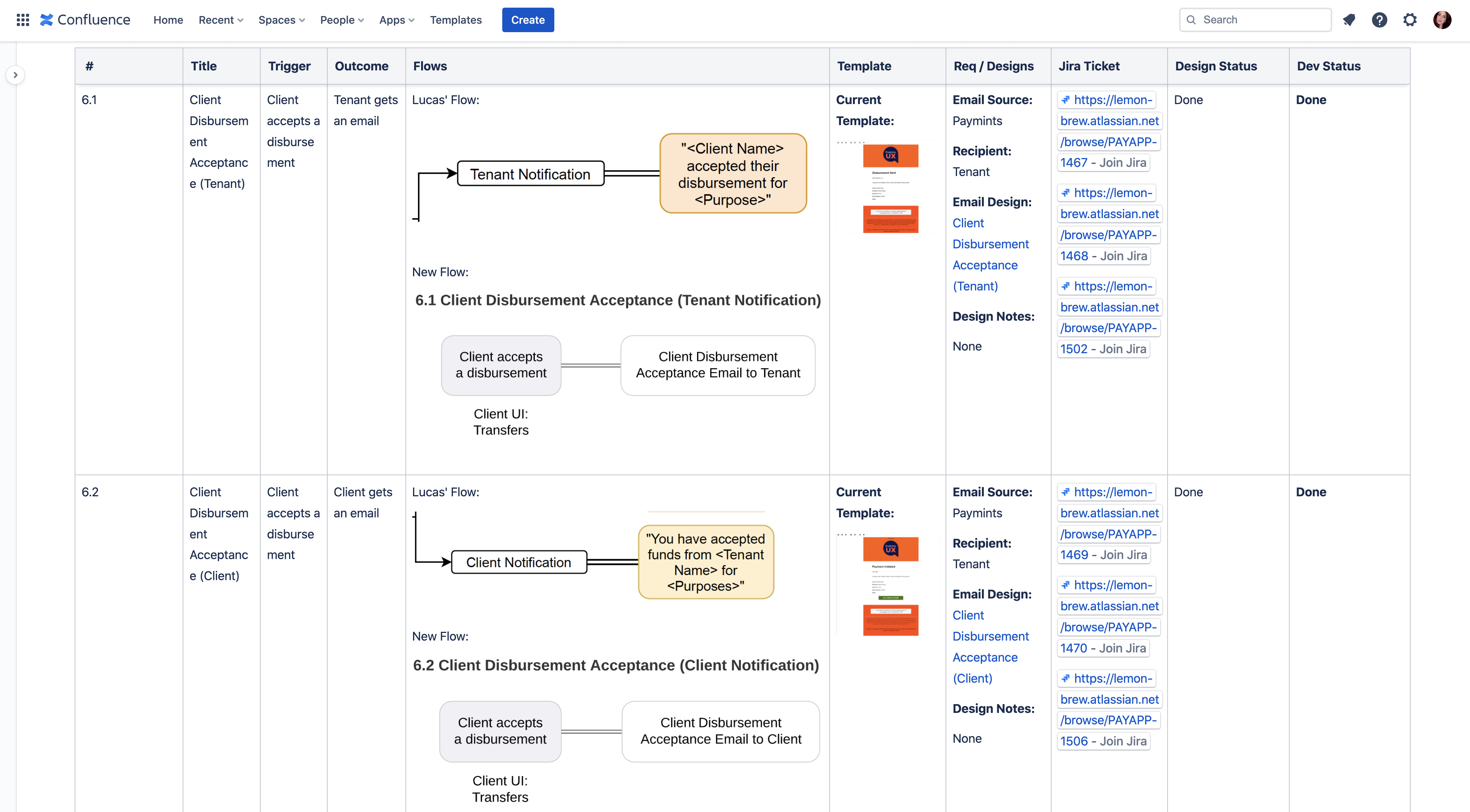

Customer Communications

Our Objective

Ensure users received the right messaging, at the right time, every step of the process.

Approach

Collaborating closely with our client, we documented 20 possible email flows, including error paths, and created templates for each one. We ensured each email was created and tested by routing all of our work through Jira where we used video messaging to ensure designs and flows were well understood by our development team.

Custom Design

Design System

Custom Icons

Custom Illustrations

The Challenge

Design, build and maintain a multi-tenant SaaS platform to handle millions of dollars in real estate transactions between title companies, buyers, sellers, real estate agents and municipalities.

They needed:

- An initial MVP launch within 6-months

- Multiple UI's to account for the various user segments

- A robust design system to speed design time

- Rapid deployments to meet time to market demands

- A microservice architecture that could grow into the future vision

- A secure payment gateway

The client had deep expertise in real estate, but not in running a technical project, so we also needed to bring them up to speed on how to build software products and best practices for defining, delivering and maintaining software.

They needed:

- An introduction to Agile

- An introduction to Product Management

- An introduction to Design Thinking and UX/UI design

- An introduction to Managing Team Knowledge

- An introduction to Support strategies

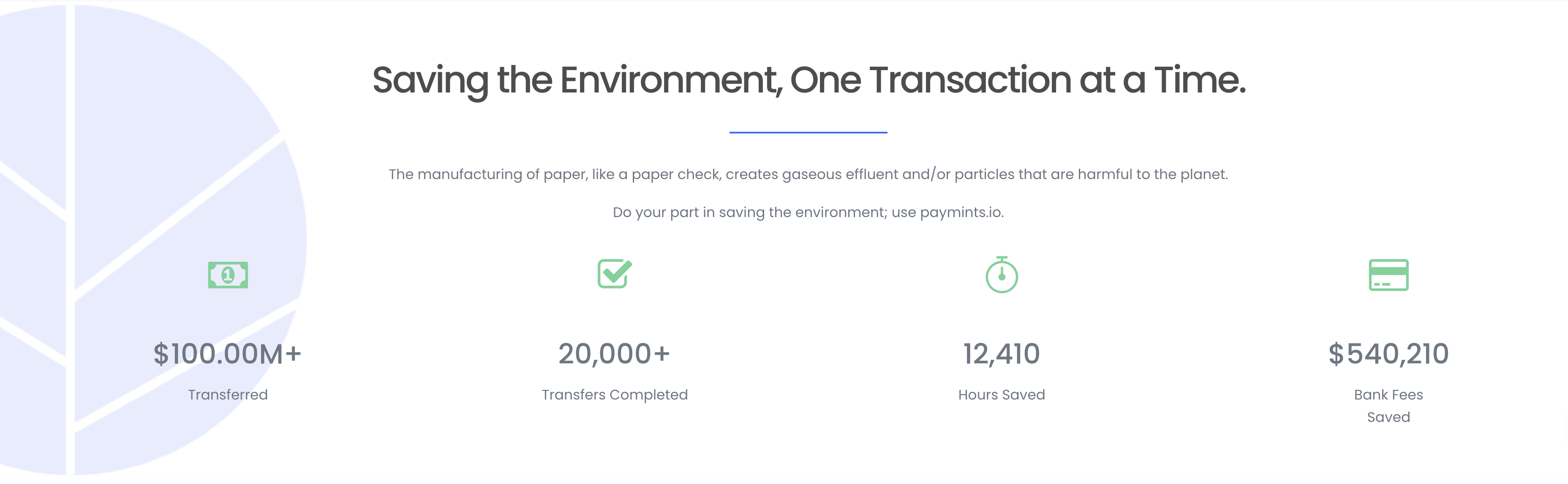

Outcomes

The outcome of our efforts resulted in a successful product launch with 2,575 transfers totaling $20.4 million completed within six months of launch and the app has now reached more than 20,000 transfers totaling $100M+. The app is continuing to grow to accommodate additional verticals and API integrations into other title company software products.

Overall, we onboarded and trained more than 30 different team members, worked with the client to produce and manage the product roadmap, and organized the work to be done. Predictive UX took great care to create a robust knowledge base so that critical information was kept up to date and easily accessible by our combined teams.

Our engineers worked closely with the client's chief technologist to build the backend solution while our design experts crafted custom UX/UI designs and illustrations and our UI development team coded multiple UIs following best practices.

OUR WORK INCLUDED

-

Product Strategy

-

Product Management

-

User Research

-

Custom Icons and Illustrations

-

Agile Management

-

Backend Architecture

-

User Stories and Flows

-

Microservices Development

-

UI Development

-

Testing

-

Deployments

-

Production Support